Have you ever dealt with an uncashed employee paycheck? For a variety of reasons employees might not claim a paycheck, though it isn't that common. Each state has some version of an unclaimed property law that addresses what to do. An uncashed paycheck is considered a financial asset and abandoned property. In California, for example, unclaimed property is that which has been left inactive for three years.

Generally speaking, if a check has been unclaimed for three to five years it becomes state property. At this point it is the state that keeps the check and provides a means to the public so it can be searched for and claimed.

The point of the Unclaimed Property Law is to prevent unclaimed property from being used by people other than the owner for their own gain.

To use California again, businesses there are required to annually review their financial records for uncashed checks. If they identify any, there is a process for reporting them to the state. The State Controller’s Office (SCO) is responsible for collecting abandoned property reports and making this information available to the public, so individuals can claim their property.

While these situations don't come up too often, a business still needs to have some policies and procedures in place should the situation arise.

4 Tips for Managing an Uncashed Paycheck

The Society for Human Resources Management has published some recommendationson how to handle the uncashed paycheck.

Contact the Employee Directly

Try to make contact with the employee or former employee by phone to discuss the paycheck(s) that were not cashed. Document any attempts your company has made to have the person collect their wages. An employer will need to show that the employee/former employee could not be located.

Contacting Employee in Writing

When phone attempts do not work, written notice should go to the employee’s last known address (or addresses); use certified mail or

have some sort of record of attempt.

Check for the Abandonment Period

Check state regulations regarding unclaimed property to find out the “abandonment period.” Keep in mind that all 50 states as well as the District of Columbia have different regulations, so it’s important to double-check.

Report the Unclaimed Property

Once the “abandonment period” passes, file and report the unclaimed property with the appropriate state authorities.

Avoiding Penalties

$400 Million Dollars Returned in New York in 2014

So far it might seem the unclaimed property is mostly about knowing the relevant legal details and following standard protocol. That’s one piece of it, but the amounts of money involved are enormous. For example, New York state returned about $430,000,000 in 2014. Yes, that’s only for one year.More than “interesting” information, a business owner, payroll manager, finance manager, accounting, CEO or CFO care should care about avoiding penalties.

In New York, failure to report abandoned property can incur a monetary penalty. "If you fail to file full and complete reports or affidavits the statute requires in the manner the Comptroller prescribes, you may be subject to penalties of one hundred dollars for each day the report or affidavit shall be willfully delayed or withheld. Refer to Section 1412 of the statute. Willfully filing false reports or making false verification is punishable under the provisions of the penal law.”

This quote comes directly from the handbook for reporting unclaimed funds in New York.

In the event you do have an unclaimed paycheck, of course you would not want to run afoul of any laws and have to add to the situation by also having to pay a penalty. One hundred dollars a day, or $36,500 per year is hardly a trivial amount, especially when you add on the cost of the time it takes to do the reporting, or to resolve the situation when it has been overlooked.

10-20% of Businesses in Compliance with Unclaimed Property Laws?

It was written in 2003 that only a small portion of businesses were in compliance with unclaimed property laws. Obviously, such information is outdated, but it might still function as indication of a potential problem.

More recently, a law firm specializing in Tax, Corporate and Finance Law wrote: “States continue to actively enforce their unclaimed property/custodial escheat laws through audit initiatives (typically involving contract audit firms). As a result, many holders of unclaimed property have belatedly found that their unclaimed property compliance policies and procedures are deficient and, in many instances, materially deficient.”

Similarly, a consultant that is familiar with the auditing process said, "For 30 years, the states have been saying to these holders: Would you please comply? And guess what. They haven't. Do you think asking them is enough? If you don't have enforcement, the holders simply will not comply," McQuillen explained.

States have become more assertive about trying to uncover unclaimed property using third-party auditing services. They stand to benefit from finding more, so there can be a clear incentive for them.

In other words, businesses might be targeted with more audits. There has been an uptick in audits, "This is something I've been handling for 20 years, and it's absolutely increased," said Kendall Houghton, partner at Alston & Bird LLP. "It's more interesting to think about why. The states have pretty much entered en masse into audit contracts. There used to be two or three go-to firms, and now there are nine or 10 firms that do multistate audits.”

A Forbes article summarized the situation nicely: “But unclaimed property has become a revenue source for states because if the state can’t find the rightful owner of the property, it keeps the property. This has made states aggressive in their audit practices. Several states use contingent-fee third-party auditors, a practice that has long been frowned on. States also use long lookback periods, which create headaches for corporations. In at least one case, Delaware demanded records back to 1981."

So, have YOU had to deal with an employee’s uncashed paycheck? What methods of resolution do you find most successful? Are you aware of your state’s unclaimed property reporting requirements?

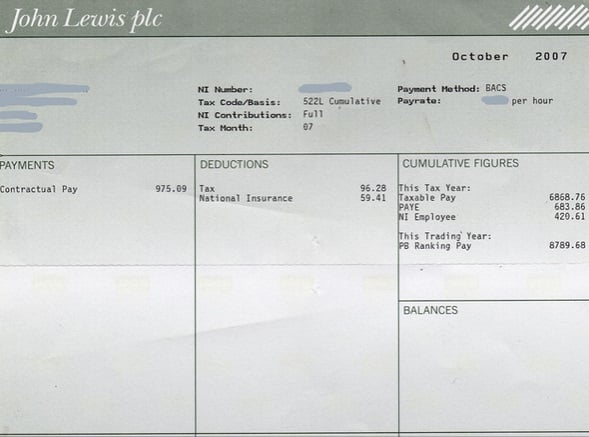

Image Credits: 1.Joe Baldwin, 2. NASA