Running payroll can be a complex process made more so by the need to be in full compliance with both state and federal labor and tax laws. No one wants to be audited by the IRS, or sued by state or federal labor departments, so it’s a good idea to keep payroll errors to a minimum. Especially those errors that are difficult to catch.

Below are six common payroll errors, that fortunately are not that difficult to fix.

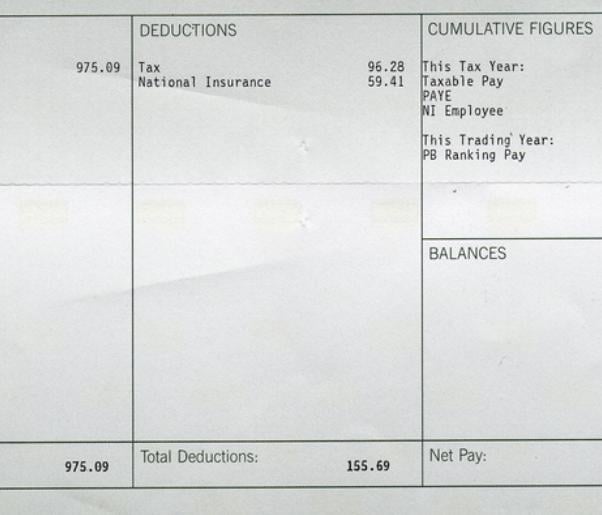

1. Misclassifying Employees

Misclassifying a worker as an independent contractor rather than as an employee.This is big mistake of course because of the possible reclassification that might come later on. If and when that happens, you are responsible for paying employment taxes, handling back withholdings and will no doubt have to pay fines and interest penalties. If you can't demonstrate proper reasons for classifying them as an independent contractor that meet IRS criteria, you might be in for a world of hurt with the IRS. Internal Revenue Code section 3509 covers this scenario. You can read more about the details of an employer's liability at the Cornell University site. The keys to understanding whether a worker is an independent contractor or an employee mostly have to do with control and independence.