Running payroll can be a complex process made more so by the need to be in full compliance with both state and federal labor and tax laws. No one wants to be audited by the IRS, or sued by state or federal labor departments, so it’s a good idea to keep payroll errors to a minimum. Especially those errors that are difficult to catch.

Below are six common payroll errors, that fortunately are not that difficult to fix.

1. Misclassifying Employees

Misclassifying a worker as an independent contractor rather than as an employee.This is big mistake of course because of the possible reclassification that might come later on. If and when that happens, you are responsible for paying employment taxes, handling back withholdings and will no doubt have to pay fines and interest penalties. If you can't demonstrate proper reasons for classifying them as an independent contractor that meet IRS criteria, you might be in for a world of hurt with the IRS. Internal Revenue Code section 3509 covers this scenario. You can read more about the details of an employer's liability at the Cornell University site. The keys to understanding whether a worker is an independent contractor or an employee mostly have to do with control and independence.

Here are a few IRS questions to ask to help make the determination:

Behavioral:

Does the company control or have the right to control what the worker does and how the worker does his or her job?

Financial:

Are the business aspects of the worker’s job controlled by the payer? (these include things like how worker is paid, whether expenses are reimbursed, who provides tools/supplies, etc.)

Type of Relationship:

Are there written contracts or employee type benefits (i.e. pension plan, insurance, vacation pay, etc.)? Will the relationship continue and is the work performed a key aspect of the business?

2. Failure to Subject Vendor Payments to Backup Withholding

Many companies, if not most, use vendors with some frequency to help run their businesses. However, it is important to be careful how they are paid, because a vendor payment could be subject to a backup withholding at a rate of 28%.

A company must obtain a W-9 before providing a payment to a vendor. It is possible even when a W-9 has been provided that the IRS could still audit you and try to collect a penalty on the amount that should have been withheld if the company was not aware the vendor payment was exempt from backup withholding.

What kind of payments are subject to backup withholding? Might as well go straight to what the IRS says:

A. "Rents and commissions, non-employee compensation for services, royalties, reportable gross proceeds paid to attorneys and other fixed or determinable gains, profits, or income payments reportable on Form 1099-MISC, Miscellaneous Income.

B. Interest reportable on Form 1099-INT, Interest Income.

C. Dividends reportable on Form 1099-DIV, Dividends and Distributions.

D. Patronage dividends paid in money or qualified check reportable on Form 1099-PATR, Taxable

Distributions Received From Cooperatives.

E. Original issue discount reportable on Form 1099-OID, Original Issue Discount, if the payment is in cash.

F. Gross proceeds reportable on Form 1099-B, Proceeds From Broker and Barter Exchange

Transactions.

G. Gambling winnings reportable on Form W-2G, Certain Gambling Winnings, unless subject to regular gambling withholding. If not subject to regular gambling withholding, backup withholding only applies if, and only if, the payee does not furnish a taxpayer identification number to the payor.

H. Gross payments reportable on Form 1099-K, Payment Card and Third Party Network."

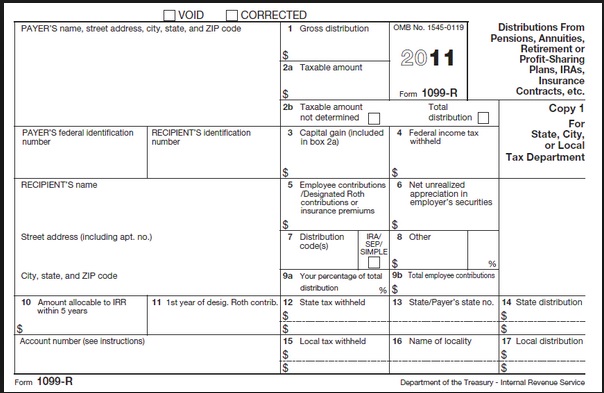

3. Not Issuing 1099s to Vendors

All vendors must receive 1099 forms. That includes all independent contractors that make $600 or more in a tax year. Penalties may results from failing to provide 1099 forms in a timely manner. These penalties are not trivial, according to Intuit, "If the institution fails to do so, the penalty against the company varies from $30 to $100 per form ($500,000 maximum per year), depending on how long past the deadline the company issues the form.If a company intentionally disregards the requirement to provide a correct payee statement, it is subject to a minimum penalty of $250 per statement, with no maximum."4. Not Including Cash Equivalents Like Gift Cards In Employee Income

You might not think of gift cards, or employee prizes and awards as necessary to report as employee income, but they can be if they are cash equivalents. If an employee receives a $250 gift card, that could be considered a cash equivalent and might be required to report as employee income. Some organizations place an emphasis on employee recognition and provide such gifts. Not understanding that they are cash equivalents and might need to be reported is an innocent enough error, but it could be a problem.An employee fringe benefit that is $75 or less probably would be considered de minimis or not taxable, such as attending a company picnic. However, some other fringe benefits of greater value may be taxable, such as cash equivalents, employer vacation home or boat use or country club dues.

5. Miscalculating State Unemployment Tax

Failing to pay the state unemployment tax can cause you to lose the federal unemployment tax credit. States like Alaska, New Jersey and Pennsylvania have employee paid tax as well as employer paid tax. Do you know who provides information for your state unemployment tax after a claim is filed? How do you determine the correct maximum wage amount?Here is a succinct summary of state unemployment tax requirements:

“Calculating what you owe in state unemployment taxes is simply a matter of multiplying the wages you pay each of your employees by your tax rate. However, every state limits the tax you must pay with respect to any one employee by specifying a maximum wage amount to which the tax applies. Once an employee's wages for the calendar year exceed that maximum amount, your state tax liability with respect to that employee ends.”

6. Not Including Expense Reimbursements As Income from Travel and Commuting for Employees

Generally, commuting and travel expense benefits are not reported as taxable income. There are some rare cases where an employee must travel long distances and over an extended period of time. Say an employee lives in Seattle and the company’s main office is also there, but the employee flies every week to South Carolina for a two-year project. This kind of long-distance travel benefit might need to be reported.Tell us what are the most common errors you see as a payroll professional? What do you do to avoid them?