As an employer, one of your most important responsibilities is properly classifying workers as either employees or independent contractors. Properly classified independent contractors can save your enterprise money, especially in the form of saved payroll taxes and employee benefits. On the other hand, misclassifying workers as independent contractors can be extremely costly. Later, we'll talk a little about how to protect yourself from misclassification lawsuits.

Consider the case of home improvement leader Lowe’s Home Centers. Last January, Lowes agreed to pay out $10 million in a settlement agreement of a class action suit brought by home improvement and installation workers who were improperly classified as independent contractors. The court found that the workers should have been classified as employees due to the fact that “Lowes had the right to control, and did control, all aspects of installation jobs.”

At the time of this settlement agreement, this was reportedly only one of the class action misclassification suits involving Lowes.

Forbes identified employee misclassification as one of the growing trends of 2015, with Lowes joining the ranks of Google and FedEx in the increasing number of well-known businesses facing misclassification issues. Uber continues to argue that its drivers should be classified as independent contractors and there is a growing belief that a third worker classification might be necessary to accommodate today's “new gig economy.”

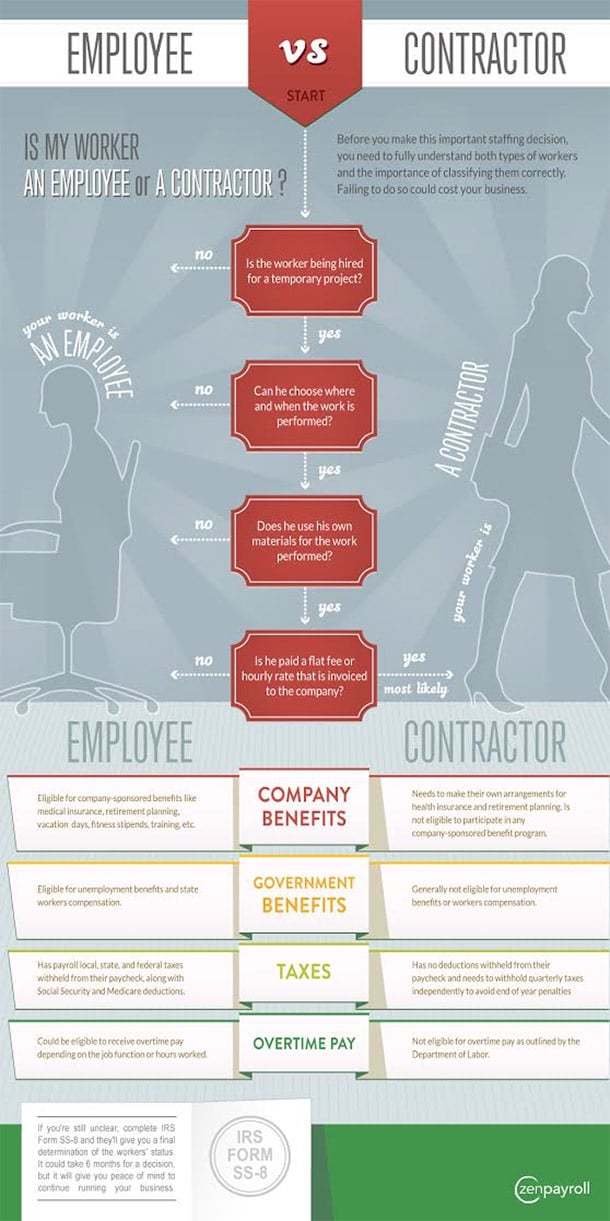

All of this serves to emphasize the importance of properly classifying your own workers. Of course, you might be thinking that this is all easier said than done. That’s why, in this post, we break down the differences between employees and independent contractors and outline the tests you can use to make sure your workers are properly classified.

Employees vs. Independent Contractors

The most basic difference between employees and independent contractors is that, as an employer, you must withhold taxes and provide benefits to employees. Employers do not have this responsibility towards independent contractors.

Employees

Under the common-law, an individual worker is an employee if a legal employer and employee relationship exists. This relationship exists if the company has the right to control and direct the details and methods of the individual’s work for that company. As an employer with employees, you have the responsibility to:

- Withhold income taxes,

- Withhold and pay Social Security and Medicare taxes,

- Pay employment tax on wages paid to an employee, and

- Provide some employee benefits.

Independent Contractors

Also known as 1099 contractors, independent contractors are workers who contract their services out to businesses and are considered to be self-employeed, rather than an employee of the contracting businesses. Independent contractors are responsible for reporting and paying their own income and Social Security taxes.

If these definitions seem a little unclear to you, don’t worry. Both the Internal Revenue Service (IRS) and U.S. Department of Labor (DOL) have multifactor tests to help you out.

Classification Tests

With both of these tests, it is important to keep in mind that there is no hard and fast rule to determine whether a worker is an employee or an independent contractor. Rather, all of these areas should be weighed against each other and classification determined on a case by case basis.

IRS Control Test

Generally under the IRS Control Test, the more control the business has over a worker, the more likely that worker is an employee rather than an independent contractor. More specifically, the IRS Control Test looks at three different areas categorizing worker control and independence:

- Behavioral – Does the company control or have the right to control what the worker does and how the worker does their job? When a worker has the ability to control the details of how the service is performed, they are more likely an independent contractor.

- Financial – Are the business aspects of the worker’s job controlled by the payer? Can the worker make decisions that affect the business’ bottom line? Remember that independent contractors can realize a profit or loss on a job.

- Type of Relationship – Are there written contracts or employee type benefits (i.e. pension plan, insurance, etc.)? If the relationship between the business and worker will continue after the task is completed, the worker is most likely an employee.

DOL 6 Factor Classification Test

In July 2015, the DOL put out a memo outlining six factors to consider when classifying workers. Slightly different from the IRS test, the DOL focuses on whether the worker is economically dependent on the employer and thus an employee, or in business for themselves and thus an independent contractor.

- Is the Work an Integral Part of the Employer’s Business? If the work performed by the worker is integral to the employer’s business, the worker is more likely to be economically dependent on the employer and thus an employee.

- Does the Worker’s Managerial Skill Affect the Worker’s Opportunity for Profit or Loss? An employee truly in business for himself (i.e. an independent contractor) faces the possibility of experiencing a loss.

- How Does the Worker’s Relative Investment Compare to the Employer’s Investment? An independent worker contractor typically makes investments that support a business, and they have an established business beyond any particular job. If the worker’s investment is relatively minor, that suggests that the worker and the employer are not on similar footings and that the worker may be economically dependent on the employer (and thus an employee).

- Does the Work Performed Require Special Skill and Initiative? Specialized skills do not necessary indicate that the worker is in business for themselves, especially if that skill is integral to performing the work.

- Is the Relationship between the Worker and the Employer Permanent or Indefinite? Permanency in the worker’s relationship with the employer suggests that the worker is an employee. An independent contractor, on the other hand, might only work one project for an employer for a specific duration of time.

- What is the Nature and Degree of the Employer’s Control? Much like in the IRS’s control test, the worker must control meaningful aspects of the work performed in order to view the worker as an independent contractor conducting their own business. Even with remote workers, employer control over work performed indicates the worker is an employee.

Ultimately, it is important to be careful and informed when classifying your workers for tax purposes. It can be tempting to purposefully misclassify employees as independent contractors to save on tax and benefits but, as we’ve noted, the consequences can be extremely costly. This is especially true if you are an enterprise based in California, where the legislature imposes steep fines for “willful misclassification” of a worker. In addition, misclassifying a worker as a contractor avoids paying overtime pay rates. If the worker is re-classified as an employee you could owe hefty back overtime, double time pay or meal penalty pay if the workers are based in California.

Keep in mind that you can change a worker’s classification if you become aware of an error by contacting the IRS. If you are still confused or concerned about the status of a specific worker, you can file a Form SS-8 Determination of Worker Status for Purposes of Federal Employment Taxes and Income Withholding with the IRS. The IRS will review the information provided on your Form SS-8 and determine the worker’s classification status for you.

Most important, classifying workers incorrectly is a profound problem in more subtle ways. The timesheet they fill out can be the completely wrong form. Or you might not even have them filling out a timesheet at all. Misclassifying workers, thereforce, means you might never capture the labor and time data you will need at all to defend against a labor lawsuit.

Image Sources: Lowes.com